Introducing Equity Modeling

Compound can now help you reliably and quickly understand your employer equity and make exercise and sale decisions using our combination of modeling tools, cap table integrations, and human advisors.

We have worked our careers in high-growth startups next to talented individuals who are clueless about the most important financial opportunities in their lives. Startup equity is *particularly* confusing. Making the right decision with your equity can potentially save you hundreds of thousands (or millions) of dollars on future taxes. The problem is there is no straightforward best practice, and the right answer depends on your situation. There exists an alphabet soup’s worth of terminology blocking you from understanding what you own, how much your equity is worth, and what you can do with your stock options and grants.

To get through this mess, you are forced to either learn obscure details of the tax code on your own or assemble a team of financial and tax advisors to triangulate a solution. Even then, you are left spending dozens of hours staring at a static PDF (stockOptionv19FinalFinal.pdf) searching for clear answers.

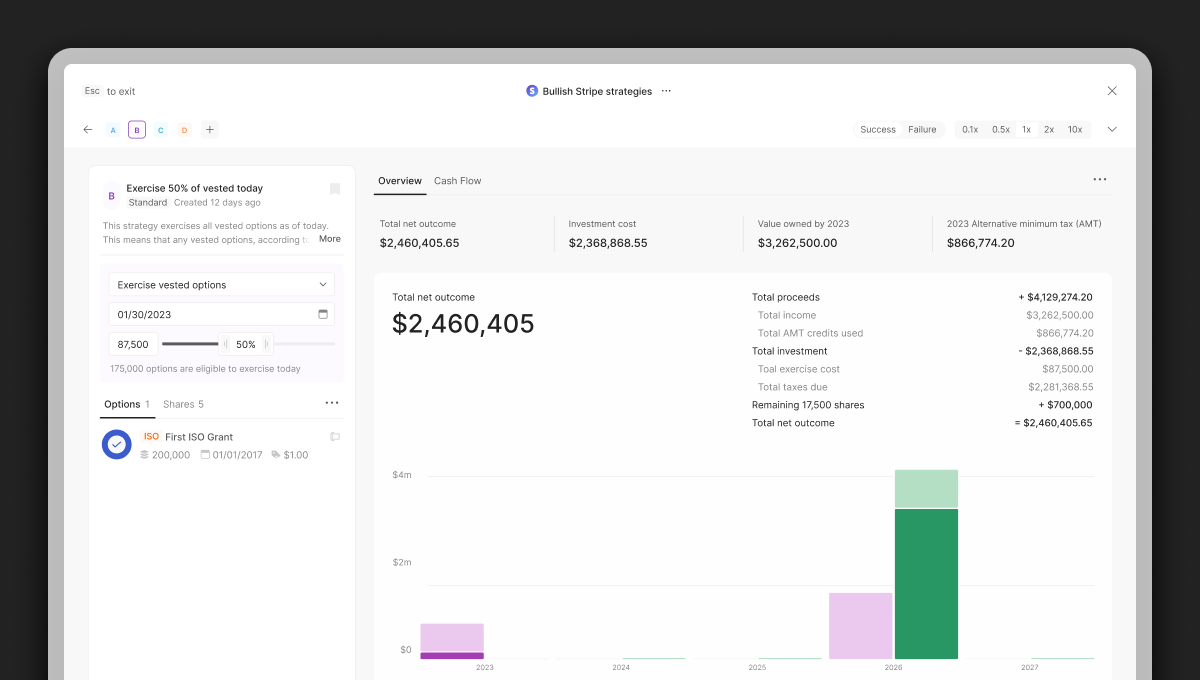

Our new equity modeling tool helps you understand and analyze your startup equity in a fraction of the time.

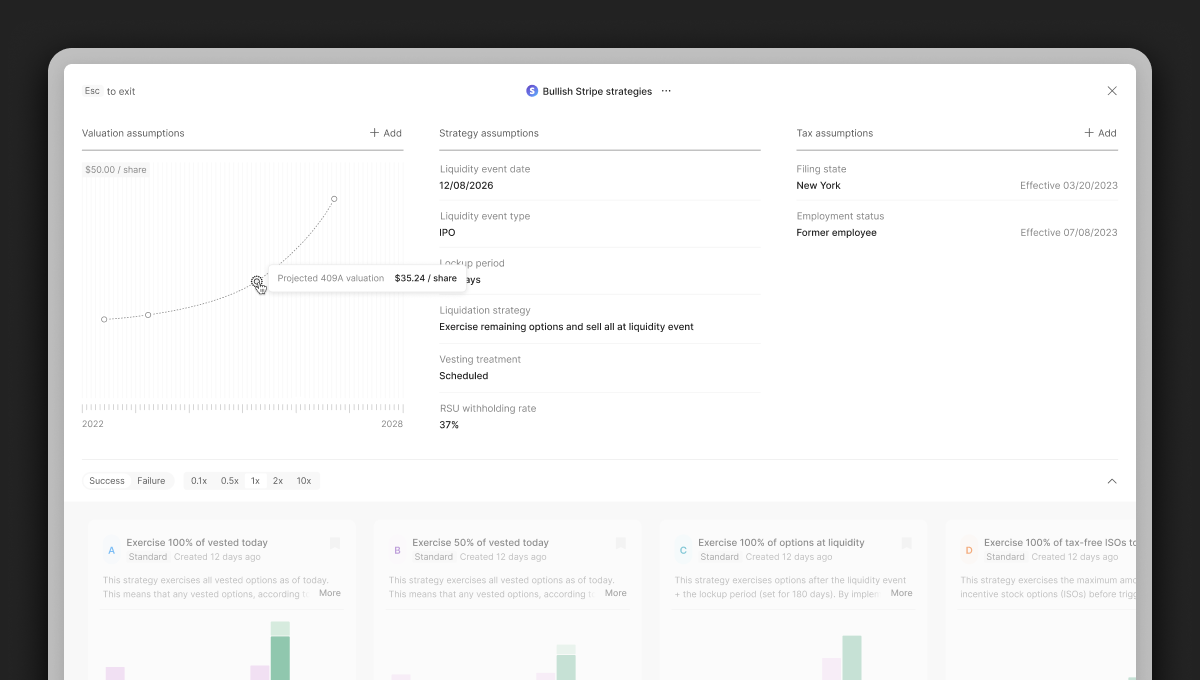

Use the tool—in tandem with your Compound financial and tax advisor—to create a multi-year forecast of the financial and tax implications of critical decisions such as early exercising, IPO planning, tender offer decisions, QSBS validity, vest events, and more.

Your advisor will guide you through scenarios (e.g. “what happens if I leave my company?”, “what happens if we raise another round of funding?”) showcasing the pros and cons of relevant exercise, sale, and hold combinations. We also walk you through lending opportunities—comparing choices like using your own cash, a non-recourse stock option loan, or a line of credit. Our intention is to help you understand the what and why behind all of the choices ahead of you, and then quickly move to implementing the how.

Equity modeling integrates with the rest of Compound, so all of your equity and tax information automatically propagate through the Compound platform (e.g. we sync with Carta and Shareworks to pull in every one of your equity grants so you don’t have to manually add your data). This connection makes tax filing easier, financial planning more comprehensive, and investments more personalized.