Introducing Secondary Market Research

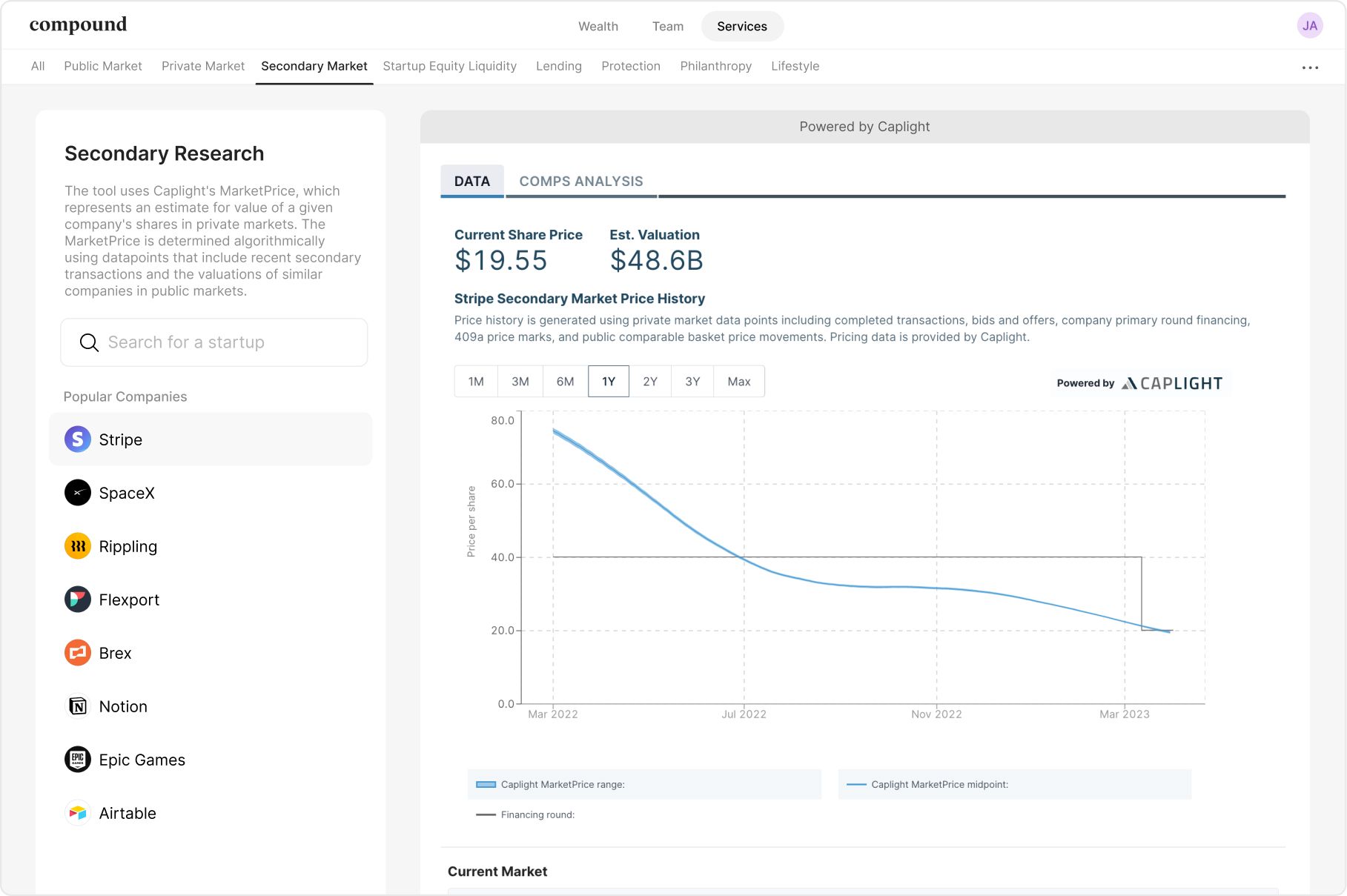

Through Compound, you can now analyze market data on private companies, which is typically hard to access, to make more confident decisions around potential secondary sales, tender offers, IPOs, and angel investments.

Understanding the value of startup shares is notoriously difficult. Unlike public company valuations, which fluctuate minute-by-minute with investors’ trading activity, startup valuations are typically set every few years when new rounds of venture financing are completed. And, although investors may be trading pre-IPO shares via secondary market transactions, good data on secondary transactions is hard to find. So between funding rounds it’s hard to know what startup shares are worth.

Compound’s Secondary Market Research tool—powered by Caplight—makes the value of your startup shares more transparent.

You can browse data on:

- How different startups’ shares are valued in secondary markets

- Which startup shares investors are looking to buy

- Which public companies are good proxies for different startups, and how those companies are valued

Data is available for hundreds of late-stage private companies.

So when it comes time to sell shares (in a tender offer or secondary sale), make an angel investment, or plan for an upcoming IPO, you have the information you need to make a confident decision.

And, if you decide to sell shares in secondary markets, Compound and Caplight can help you find a buyer and complete the transaction.

Visit the Secondary Research page to get started.